|

Note |

|

The Toast platform functionality described in this section is in limited release. |

For Toast restaurants, a marketplace facilitator is a business that:

-

Takes guest orders, processes guest payments, and then directly submits those orders to a Toast restaurant for fulfillment.

-

Is required by a taxing authority to pay tax amounts for the orders they process.

For example, a restaurant ordering service like the Local by Toast app, Toast Local, Grubhub™, Uber Eats™, or DoorDash® that accepts orders for a large number of restaurants might take guest orders and payments and then submit the order to the Toast platform for fulfillment at a Toast restaurant. The ordering service receives the guest payment and then remits the applicable tax amounts.

A marketplace facilitator might not remit all tax amounts for a Toast platform order. For example, a marketplace facilitator might remit all state tax amounts but not remit local tax amounts. You can determine whether a marketplace facilitator has remitted tax amounts for your restaurant's orders by checking the tax information in Toast platform reports. For more information, see Tax payment reporting information. Marketplace facilitators might calculate tax amounts differently than the Toast platform does.

|

Important |

|

The tax remittance and tax amount reporting information in the Toast platform is not intended to be guidance for complying with tax requirements. Seek qualified tax guidance if you need assistance. |

The marketplace facilitator tax amount behavior described in this section only applies to orders that are directly submitted from the marketplace facilitator to the Toast platform. Your restaurant might receive orders that originated at a marketplace facilitator but then passed through another order handling service before being digitally submitted to the Toast platform. For example, if your Toast platform restaurant uses a direct integration with a marketplace facilitator ordering partner, the orders you receive through that integration are included in marketplace facilitator tax amount handling and reporting. Orders you receive indirectly from a marketplace facilitator, through a different ordering service, are included in reporting using tax rates configured in the Toast platform and are not included in marketplace facilitator reporting.

If your restaurant uses a Toast API integration that gets information about orders, the order information that you get from Toast APIs includes information about tax amounts remitted on behalf of your restaurant. For more information, see Marketplace facilitator tax information.

The following sections provide more information about marketplace facilitator tax payments:

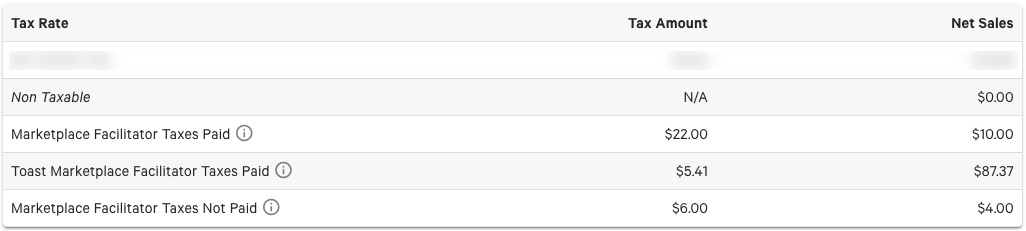

You can see the tax amount that a marketplace facilitator remitted for an order in the Toast platform reporting information for your restaurant.

The tax amount information for those orders is presented in categories that indicate whether the marketplace facilitator has remitted the tax amounts for a guest payment on behalf of your restaurant or has not remitted those tax amounts.

Marketplace facilitator tax information reporting categories

-

Marketplace Facilitator Taxes Paid - tax amounts for which the marketplace facilitator has remitted tax payments on behalf of your restaurant

-

Toast Marketplace Facilitator Taxes Paid - tax amounts for which Toast has remitted tax payments for your restaurant. For Local by Toast app and Toast Local orders only.

-

Marketplace Facilitator Taxes Not Paid - tax amounts for which the marketplace facilitator has not remitted tax payments on behalf of your restaurant.

You will only see tax amounts categorized as Marketplace Facilitator Taxes Not Paid if the following conditions are met:

-

Your restaurant location is in a taxing jurisdiction that only requires marketplace facilitators to remit the taxes for that jurisdiction and not taxes for other jurisdictions (for example local or municipal taxes).

-

The marketplace facilitator organization chooses to remit only the taxes that are required by the marketplace facilitator laws for the taxing jurisdiction. Some marketplace facilitators might choose to remit all taxes, even if they are not required to do that.

For information about how a marketplace facilitator organization remits tax amounts in a specific taxing jurisdiction, contact that marketplace facilitator directly.

-

Marketplace facilitator tax payment information is available in the following reporting resources.

-

The tax table section of the Sales Summary report. Choose Reports > Sales > Sales summary to open the Sales Summary report tab.

-

The Taxes table of the Accounting Overview report. Choose Reports > Accounts > Accounting overview to open the Accounting Overview report.

The following diagram shows marketplace facilitator tax amounts in the Sales Summary report.

|

Note |

|

Toast Marketplace Facilitator Taxes Paid only appear in the Sales Summary report. For a cumulative total of all Marketplace Facilitator Taxes Paid, see the Accounting Overview report. |

|

Note |

|

Toast platform reporting information includes many aggregated tax calculations that are not broken down by marketplace facilitator tax payment categories. This excludes Local by Toast and Toast Local which can be found in the Sales Summary Report. Aggregated tax amount calculations other than the ones described in this section include both paid and unpaid marketplace facilitator tax amounts. |

To calculate the amounts used for taxes, refer to the orders API

AppliedTaxRate object. For more information about this

object and how it applies to marketplace facilitators, see Reviewing marketplace facilitator tax calculations.

For instructions on how to calculate the total marketplace facilitator tax paid for an order, see Calculating total marketplace facilitator tax paid.

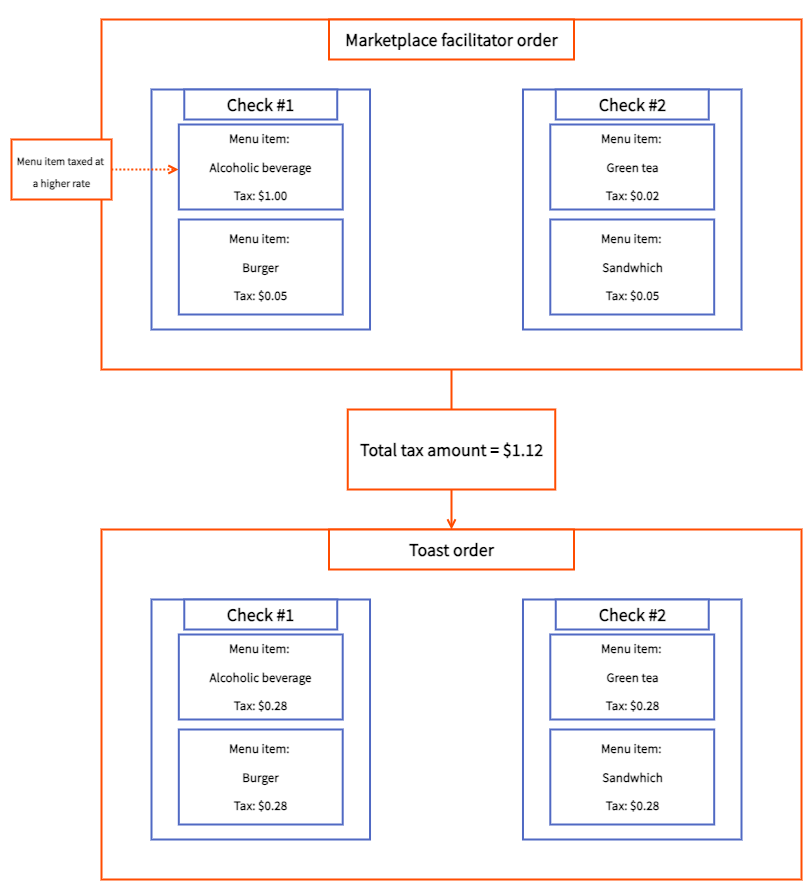

The tax amounts for marketplace facilitator orders are aggregated for each guest check in an order. Tax amounts that apply to specific items in an order are not reported separately from other items. For example, if an item in an order is subject to an alcoholic beverage tax, that tax amount is aggregated with the other tax amounts for the order in Toast platform reporting information.

Marketplace facilitators report the tax amounts for each order when they submit the orders to the Toast platform. The Toast platform divides the sum of all tax amounts proportionately by item price among all items in all checks in an order.

The following diagram shows the tax amount aggregation for a marketplace facilitator order that includes items that are taxed at different rates. In this example the item prices are all equal.

When your Toast restaurant receives an order from a marketplace facilitator, you cannot make changes to the order. The Toast platform protects marketplace facilitator orders from changes because those orders match information that originated in the marketplace facilitator transaction.

You cannot refund a marketplace facilitator order. The marketplace facilitator who processed the original order and received the guest's payment must refund the guest.

|

Note |

|

Orders that originate from the Local by Toast app and Toast Local can be changed and refunded. |