|

Note |

|

For completeness, this section covers the use of default tax rates and inheritance to assign applicable taxes. However, the automated nature of defaults and inheritance makes it harder to understand what taxes are being applied. For this reason, Toast support typically recommends that you manually set applicable taxes on your menus instead, as described in Manually assigning applicable taxes. If you choose to use the defaults and inheritance technique, this section provides the information you need to know and the issues you can encounter. |

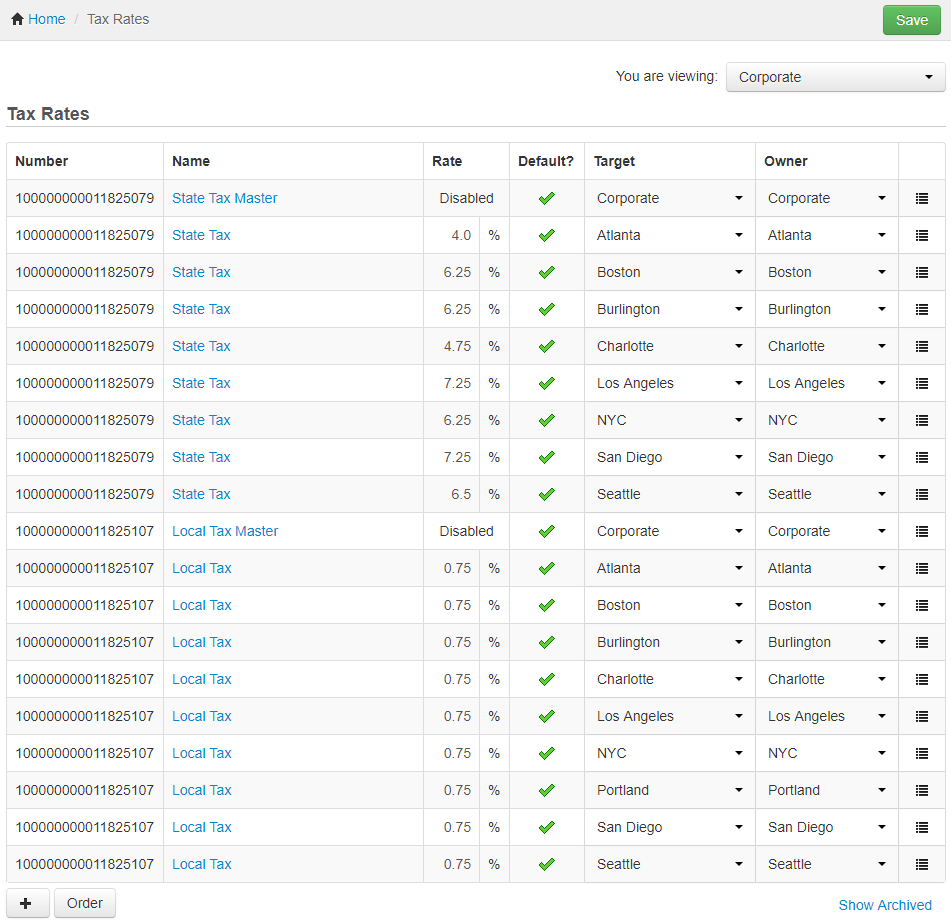

Taxes that are marked as default are indicated by a check mark in the Default column on the Tax rates page. When a menu is configured to inherit taxes, the Toast platform ignores any tax rates that are not marked as default. For example, in the following illustration, the Boston versions of the state tax and local tax rates are marked as default:

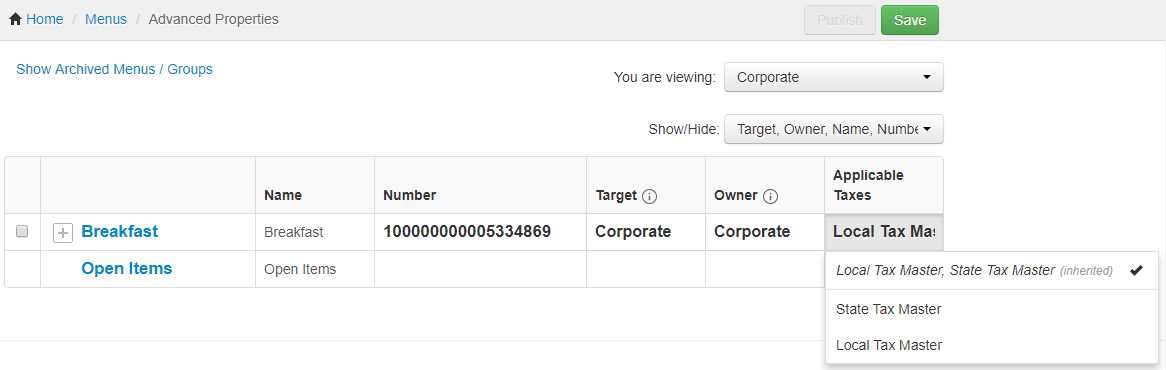

And, on the Advanced properties page, the Breakfast menu is set to inherit the State Tax Master and Local Tax Master taxes:

With this configuration, the state tax and local tax for Boston are applied to the Breakfast menu. None of the other state and local taxes are applied because they are not marked as default, even though they are all versions of the same State Tax Master and Local Tax Master tax rate. In order for all of the taxes associated with a master version to be applied, they must all be marked as Default. So, if you choose to use the default/inheritance method, you must:

-

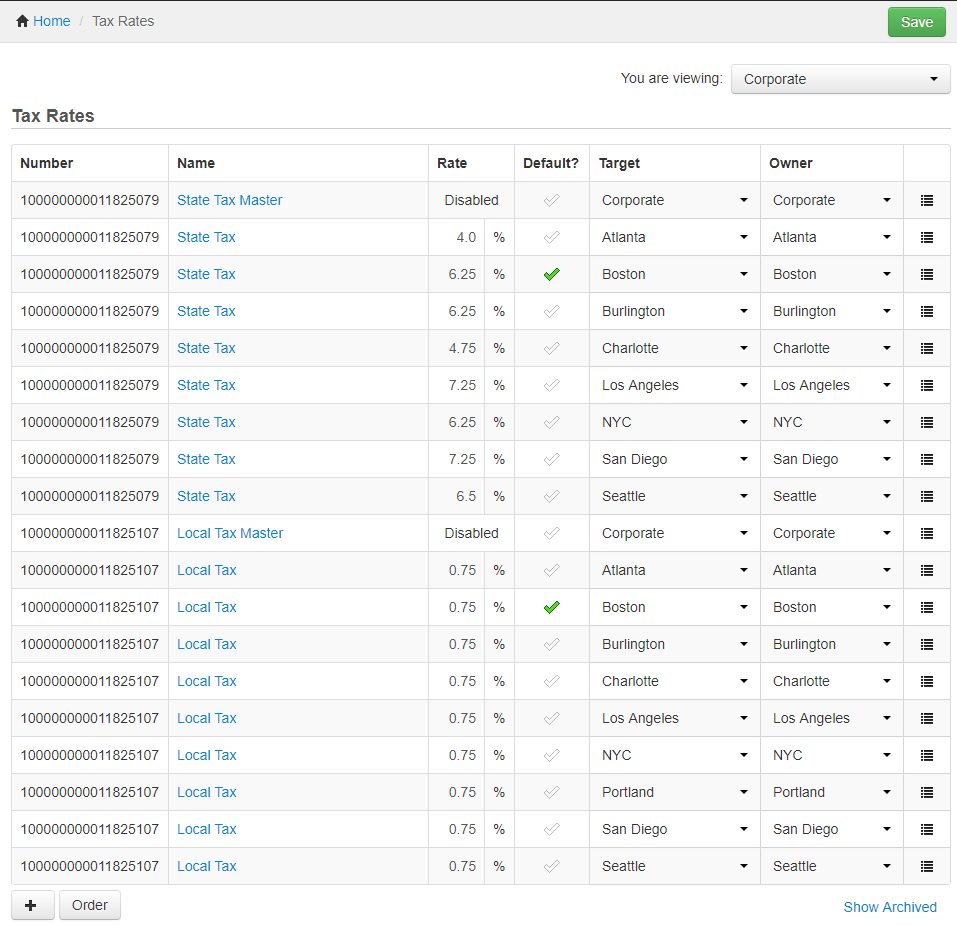

Mark all of your tax rates as default, for example:

-

Configure your menus to inherit the default taxes by choosing the (inherited) option in the Advanced Properties table. This option appears above the line in the Applicable Taxes field for the menu you are configuring. Note that the label associated with the (inherited) option is intended to represent all of the taxes that are marked as default but this label can be difficult to decipher. Regardless of the label, know that selecting the (inherited) option will apply tax rates that are marked as default on the Tax rates page.

-

Publish your changes using the Publish config page. See Publishing changes for multiple locations for information on accessing and using that page.